ESPC House Price Report July 2018

Here's an instant guide to what's been happening in the property market.

Download the ESPC House Price Report July 2018 infographic

Key Points

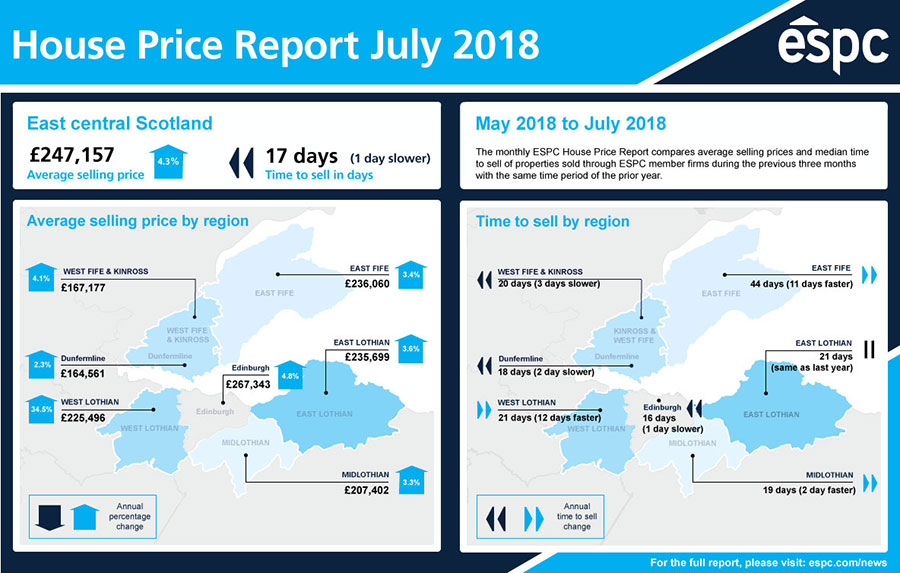

- The average selling price in east central Scotland increased to £247,157 between May and July 2018, which is a 4.3% increase compared to the same period last year.

- The number of homes sold in east central Scotland between May and July 2018 decreased by 9.9% in comparison to the same period in 2017. This is more of a reflection of a decrease in properties coming to market in previous years rather than a decrease in buyer demand.

- The percentage of sales achieving or exceeding their Home Report valuation rose to 82.3% between May and July 2018, compared to 78.9% for the same timeframe last year.

- The average percentage of Home Report valuation achieved was 105.2%, an increase of 0.7% on last year’s figure.

- The median time to sell in east central Scotland between May and July 2018 was 17 days, which is one day slower than last year.

- The number of new homes brought to market between the months of May and July increased by 3.4% annually.

- 89% of properties listed were marketed as ‘Offers Over’, compared to 83.6% in 2017.

Reassuring increase in properties coming to market continues

This month has seen a continued upswing in the number of properties coming to market compared to last year, which is a highly positive sign for buyers. The number of new homes brought to market between the months of May and July increased by 3.4% annually. This is a slight increase compared to last month, when the annual increase in new homes being listed was 3.2%.

Across east central Scotland, average selling prices rose by 4.3% to £247,157 compared to the same period last year. In Edinburgh, average selling prices increased by 4.8% compared to last year, to £267,343. Within the capital, three-bedroom houses in South Queensferry and Dalmeny saw the biggest increases in average selling prices, rising by 13.8% to £229,561.

The average selling prices of two-bedroom flats in Newington, Grange and Blackford rose by 12.5% to £300,360. One-bedroom flats in Polwarth, Shandon and Tollcross rose by 11.8% to £199,755, and these flats also boasted the highest average percentage of Home Report valuation achieved at 113%.

Properties in West Lothian also saw a significant increase in average selling prices, rising by 34.5% to £225,496. This average selling price between May and July 2018 was driven up by a cluster of sales of high-end properties over £400,000.

The median time to sell across east central Scotland was one day slower than last year, with half of all properties going under offer within 17 days. In Edinburgh, the median time to sell during this period was 16 days.

One-bedroom flats in Leith, Easter Road, Pilrig and Bonnington were the quickest to sell during this period, with a median selling time of nine days. One and two-bedroom flats in Leith were the property types that sold the most during this period.

The number of properties sold in east central Scotland decreased by 9.9% in this period compared to last year, but that is more of a reflection of a decrease in properties coming to market in previous years rather than a decrease in buyer demand.

ESPC’s Business Analyst Maria Botha-Lopez said: “It is particularly encouraging to see the number of properties being listed continuing to increase compared to last year. A shortage of properties coming to market has been limiting the local property market in recent years, so an increase in properties coming to market is a positive sign for buyers.

“Average selling prices are also continuing to rise steadily across east central Scotland, which is good news for homeowners and sellers. However, it’s preferable when these increases are such that they do not prevent buyers from being able to afford to purchase properties.

“The Bank of England’s decision to increase the interest rate from 0.5% to 0.75%, in line with their policy of increasing the rate in small increments to manage inflation, is unlikely to have a major short-term impact on the property market, and these are still historically low interest rates.”

View the house price table

Got a question? Have a look at our House Price Report FAQs

Want to know about previous months and years? Read our historical house price data