Why should I take out an ISA?

Why should I take out an ISA?

For those looking to buy their first home, the options for savings products can be overwhelming and in some cases, confusing. Ensuring you’re making the best choice for your particular circumstance can take a lot of time and research.

Two products designed to encourage saving are the Lifetime ISAs and the Help to Buy ISAs. ESPC Mortgages look at the differences between the two.

What is the difference between a Help to Buy and Lifetime ISA?

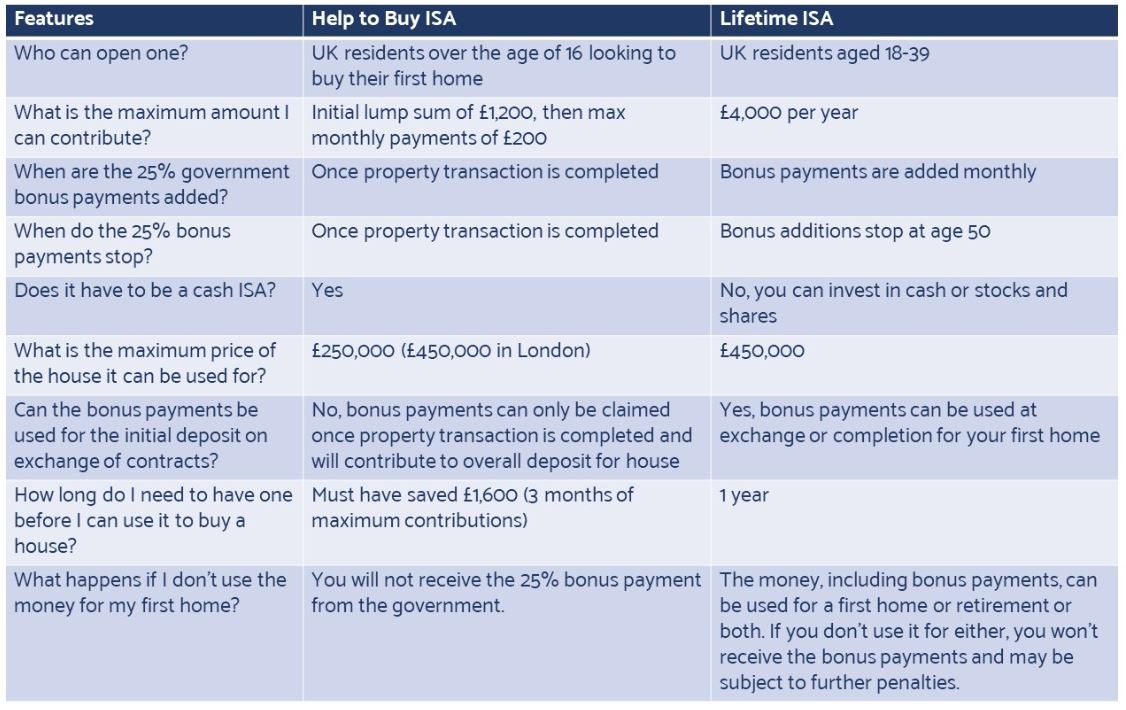

Lifetime ISAs or LISAs were introduced in the Budget in 2017 to run alongside the already established Help to Buy ISAs (HTBISA) that were introduced in December 2015. The concept is broadly similar in that both schemes are designed to encourage savings to help first time buyers get on the property ladder. However, a LISA can also be used to save for retirement. Both schemes benefit from a generous government bonus of 25% on the total amount saved.

Find out some of the key aspects of both ISAs in the table below or download our table here.

How do I open a Help to Buy or Lifetime ISA?

Both types of savings are offered by many High Street lenders and can be easily opened online. However, there is a greater choice of HTBISAs over LISAs. Each individual is entitled to their own account (subject to criteria); therefore, if you are buying as a pair or a couple then each of you can benefit from the bonus element of your own individual HTBISA or LISA.

What if I don't buy a property?

In the event you don’t go ahead and purchase a property or utilise the LISA funds for retirement then you can withdraw the accumulated savings – however, you won’t benefit from any of the 25% government bonus payments. Furthermore, you may incur penalties which could amount to up to 6.5% of the amount withdrawn.

So which ISA is right for me?

Overall, you can benefit more in the longer term from a LISA. Equally if you plan on purchasing a home quickly (within a year) then an HTBISA may be more appropriate as this can be utilised at any stage as opposed to a LISA which must be in force for at least one full year prior to being utilised.

It’s also worth noting that the Help to Buy ISA is due to close to new customers on 30th November 2019. After that date, only existing customers will be able to pay into their accounts. Existing Help to Buy ISA customers can transfer their funds, up to £4,000 into a Lifetime ISA at any time. First time buyers can only use either the Lifetime or Help to Buy ISA to purchase their first home, not both.

Information on buying your first home

if you are looking to find out more information on the buying process check out our first time buyers guide here.

ESPC Mortgages can help with all aspects of understanding your budget, applying for a mortgage and dealing with the relevant insurance requirements. Pop in for a no obligation chat with Peter or a member of the team at our Edinburgh Property Information Centre, or give them a call on 0131 253 2920.

The information contained in this article is provided in good faith. Whilst every care has been taken in the preparation of the information, no responsibility is accepted for any errors which, despite our precautions, it may contain. No Individual mortgage advice is given, nor intended to be given in this article.

The initial consultation with an adviser is free and without obligation. Thereafter, ESPC Mortgages charges for mortgage advice are usually £350 (£295 for first time buyers). YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR OTHER LOANS SECURED AGAINST IT.